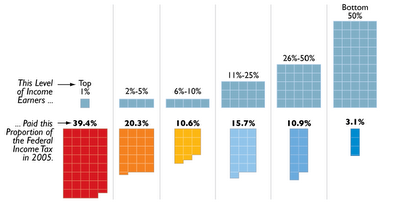

This chart illustrating the 2005 income tax burden from the Heritage Foundation is very enlightening:

What this means is:

The top 1% of income earners are paying 39.4% of Federal Taxes.

The top 5% of income earners are paying 59.7% of Federal Taxes.

The top 10% of income earners are paying 70.3% of Federal Taxes.

The top 25% of income earners are paying 86% of Federal Taxes.

The top 50% of income earners are paying 96.9% of Federal Taxes.

The bottom 50% of income earners are only paying 3.1% of Federal Taxes.

These quotes come to mind on this aspect of heavily taxing a minority:

Milton Friedman:

"Congress can raise taxes because it can persuade a sizable fraction of the populace that somebody else will pay."

"A government which robs Peter to pay Paul can always depend on the support of Paul."

-- George Bernard Shaw

Vanya Cohen:

When there's a single thief, it's robbery. When there are a thousand thieves, it's taxation.