Wednesday, November 30, 2011

1099K - PAYPAL & AMAZON

A. The best I can tell is that the credit card and debit card companies, including PayPal, will be sending out 1099K's with copies going to the IRS. Apparently the IRS will not be able to match so they are saying put 0 in the box.

As far as a link, I will look. I actually heard this at the Washington Tax Conference.

Tuesday, November 29, 2011

HIP TO BE SQUARE

Have you seen the new Square credit card app?

Have you seen the new Square credit card app? We use it when we are on the road to ring up credit card sales. It is really handy.

Developed by Twitter founder Jack Dorsey, this app allows merchants to accept credit cards via a small, square swiping device that plugs right into an iPhone or Android device. The only charge is a 2.75% transaction fee on every purchase.

In May they launched a new program called Square Register, a free iPad app that acts as a complete point of sale system for businesses It manages inventory and runs sales analytics. I have not used this software.

Here is how the software works. The customer swipes their cards on the Square card-reading device and sign their name directly on the screen of the iPad. They receive an email or text message receipt.

Customers with smart phones can download an app called Square Card Case, which allows them to set up and keep a tab with the merchant. When a customer activates the app and makes a purchase, his or her name appears on the merchant's iPad, and the merchant charges the account. The transaction is done completely over the iPad and the phone.

How long before a young person asks you "what was that stuff called cash that you used to use?"

ACCOUNTANTS IN THE MOVIES

In Hollywood, accounting can seem like a pretty glamorous profession, or not.

In Hollywood, accounting can seem like a pretty glamorous profession, or not.Ben Kingsley played compassionate accountant Itzhak Stern in the Oscar-winning 1993 Steven Spielberg movie, "Schindler's List." Stern was a real-life accountant who worked for German industrialist Oskar Schindler, played by Liam Neeson. The accountant typed and maintained the list of names of his fellow Jews who were hired to work in Schindler's factories, preventing them from being sent to the Nazi death camps. The real Itzhak Stern appeared in the movie, along with the surviving people on Oskar Schindler's real-life list.

Thursday, November 24, 2011

HAPPY THANKSGIVING

Thanksgiving Day brings to mind

the blessings in our lives

that usually go unnoticed:

a home that surrounds us

with comfort and protection;

delicious food, for pleasure

in both eating and sharing;

clothes to snuggle up in,

books and good entertainment

to expand our minds;

and freedom to worship our God.

Most of all we are thankful

for our family and friends,

those treasured people

who make our lives extra special.

You are part of that cherished group.

On Thanksgiving, (and every day)

we appreciate you.

Happy Thanksgiving

From Kopsa Otte

Wednesday, November 23, 2011

NEW ADDITION

Megan had a beautiful little girl yesterday.

7lbs 8oz. and 20 inches long

Tuesday, November 22, 2011

ACCOUNTANTS IN THE MOVIES

In Hollywood, accounting can seem like a pretty glamorous profession, or not.

In Hollywood, accounting can seem like a pretty glamorous profession, or not.Jack Lemmon plays an accountant in the 1954 comedy "Phffft!" who decides to split with wife Judy Holliday after eight years of marriage. He met her while doing her taxes, and even after they break up and start seeing other partners, he continues to keep her as a client. The unusual title is supposed to be the sound of a marriage losing steam. Lemmon also played an accountant in Billy Wilder's 1960 comedy, "The Apartment," in which he lends his apartment to boss Fred MacMurray for assignations with girlfriend Shirley Maclaine. The movie was later the basis of the musical "Promises, Promises."

Monday, November 21, 2011

529 PLAN FOR COLLEGE

A. It was great to visit with you at your pretax appointment. Here is some more information about 529 Plans.

Saturday, November 19, 2011

FICA TAX ON TIPS

A new program has been announced by IRS that uses data from employees' Forms 4137, Social Security and Medicare Tax on Unreported Tip Income, to determine the employer's share of FICA taxes on unreported tips.

A new program has been announced by IRS that uses data from employees' Forms 4137, Social Security and Medicare Tax on Unreported Tip Income, to determine the employer's share of FICA taxes on unreported tips.Employees use Form 4137 to report and pay their share of Social Security and Medicare taxes (FICA taxes) on tips that they did not report to their employer.

The IRS believes that employers in industries where tipping is common know that they must pay the employer's share of FICA taxes on tips that employees report to them. However, IRS feels that many employers do not realize that they may be liable for these taxes on tips employees do not report to them.

Employers are subject to FICA tax on unreported tips. An employer's liability for its share of the FICA taxes on unreported tips does not arise until it receives a Notice and Demand from IRS which instructs the employer to include the FICA taxes shown on the notice and demand on the employer's next Form 941, Employer's Quarterly Federal Tax Return. An employer will not be subject to any interest charges or deposit penalties if it properly reports the taxes as instructed in the notice and demand, and remits the tax due with its Form 941, or if it timely makes a deposit that is required to be made in accordance with the notice instructions.

In the past, IRS issued notice and demands based on tip audits using estimates, including data from Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips. Under the new initiative, the Notice and Demand will be based on information that IRS collects from employees' Forms 4137.

IRS generally intends to notify an employer at least 30 calendar days in advance of the issuance of a Notice and Demand by issuing a pre-notice. IRS has a designated staff to help resolve any discrepancies that are noted by employers on the pre-notice.

Observation: I have yet to see any of these new notices. If by chance you were unlucky enough to receive one please let me know. I am interested on how the IRS is actually handling this.

Tuesday, November 15, 2011

WASHINGTON D.C. UPDATE PART #4

- If you are under 55 and they made no changes to the law so you can expect to receive 77% of the benefits that you normally would be eligible for; if you are over 55 you should receive 100% of the benefits.

- To fix the program Congress needs to do one of two things, or some combination:

Increase income from payroll taxes by 17%

Reduce current benefits by 14%

- Social Security was never meant to provide 100% of the living expenses for retired individuals.

- 80 million baby boomers will be eligible for Social Security in the next 10 years.

- As a cost cutting measure the Social Security Administration has quit sending out the annual Social Security Statements that you normally received around you birthday. They are going to be providing the information on line, but they can't figure out how they are going to do that. Make sure you keep your last statement.

- Right now if you retire at age 62 versus age 65 you will get 75% of full benefits. The decision depends on your individual circumstances.

- The Social Security system is not a "the more you pay in the more you get." The lower 30% get much more than they pay in and more than the higher 70%.

WASHINGTON D.C. UPDATE PART #3

The IRS now can request backup copies of your software.

This is going to give them access to entries not only to your books but also it will allow the auditor to look at adjustments and changes that were made to your books by looking at the audit trail.

This is concerning. Think about yearend adjustments that are made when cleaning up the books and then when doing tax planning. The auditor is going to see those changes and will be asking questions.

Here is an example: Assume the owner of the business takes money from the business during the year. The bookkeeper classifies this as a loan. After the yearend we are looking at the transactions and determine that this actually should have been a dividend. On March 1st of the subsequent year we either make an entry or reclassify the check. The auditor is going to know about the entry through the audit function and think that we are doing some "hankie pankie" post yearend planning.

Here are some of the questions and answers addressed by the panel from the IRS:

Q. Is this legal?

A. Yes. We have been to court several times and in all cases the judge has ruled that we should have access to the electronic books because they are the books of original entry.

Q. Could we turn off the audit function?

A. Yes but that would make us suspicious and would probably extend the audit. What are you trying to hide?

Q. What if the client uses QuickBooks as a checkbook and then the accountant takes the QuickBooks and makes entries. Can they still request?

A. Yes

Q. If the auditor has the books can he look at prior years? If he is looking at prior years he is supposed to open an audit for those years. Will they be looking at those years?

A. We have told the auditors during training not to look at prior years.

Q. HERE WAS MY QUESTION. Many clients have point of sale software that keeps track of transactions and inventory along with accounts receivable but is not downloaded into the general ledger. Is this type of software subject to review?

A. Yes. This is considered part of the books of original entry and is subject to request.

Q. What if the electronic books are kept by the accountant. Can they still be requested or subpoenaed?

A. Yes.

Because of this new initiative by the IRS we are going to have to be more diligent in our recording into QuickBooks and other electronic software and be prepared to answer questions of why entries were made to change or to make journal entries after the end of the business year.

WASHINGTON D.C. UPDATE PART #2

I spoke with the Commissioner of the Small Business about the frustration that salon owners have with employees going to booth rental. I gave him my card and he said he would check this out and get back to me. I will keep you posted on what I hear back from him.

Independent contractors are on the radar.

There is a new initiative to have owners that are improperly treating workers to come forward and admit their mistake. The cost would be penalty of 10% of the payroll tax due for the prior 12 months. This is an effort by the IRS to allow businesses to get it right before they start a hard clamp down on worker classification.

The IRS is now doing an extensive study sampling worker classification

Estimates are that $64 billion is being lost in payroll taxes by misclassification.

Hard lobbying in Washington to eliminate the Section 530 Relief.

Efforts by the IRS to find employers that are improperly classifying workers:

- Independent research study on the issue

- New IRS specialist to help field auditors with the issue

- More exams

- 1099/W-2 comparisons within individual industries

- Working with the states on classification. States are getting much more active.

- Flagging businesses with more than 5 1099's showing more than $20,000; thus indicating the use of independent contractors and workers.

WASHINGTON D.C. UPDATE PART #1

I wanted to share with you some highlights. This is really important because future tax policy is going to hit us right in our bank account. With taxes scheduled to increase substantially and with the economy waning the more we know the better we can plan.

Here is Part #1 of this 2 1/2 day conference:

+ Nobody can outguess what Congress is going to do. Even the 'insiders' are concerned about the lack of direction.

+ We are fairly safe in planning for 2012. It is an election year so we won't see a lot of major changes. But in 2013 the Bush/Obama laws will be phased out and it is going to be a battle. If the past is any indication we may not know what the 2013 laws will be until late in the year. This is going to make planning in 2012 very important.

+ In 2011 we can take 100% write-off on certain leasehold improvements. This is scheduled to reduce to 50% in 2012 and then disappear in 2013. With the economy as it is we may see the ability to take 100% continue thru 2012- there is a chance but don't count on it. We are watching this for you.

+ The same is true with the write off of equipment. It reduces from $500,000 this year to $139,000 in 2012. This may also be extended. We are watching for you.

+ Many business owners are planning/hoping that Obama Care will be repealed. One of the Congressmen that spoke said that in his opinion it will not be repealed no matter who wins the White House. The Congressmen’s thinking is that it would take 60 Senators to overturn the bill and that will not happen.

+ The extremely high tax rates for people making over $200,000 are getting closer. With the exit of the Bush/Obama cuts; the Obama proposal to raise taxes on those wealthy people making over $250,000; and Obama Care laws tax increases for Medicare coming in 2014 rates could go as high as 43.4%. Plus we still have Social Security and State taxes ~ Ouch.

+ Everything is now political. It used to be a few years back that the leaders from the two parties would get together to work out solutions to problems. This does not happen anymore.

+ Estate planning is a mess. In 2011 and 2012 you can have an estate of $5 million and no estate tax. Any of the $5 million that you do not use you can pass to your spouse. In addition you can give $5 million. But in 2013 the estate drops to $1 million. Who knows how to plan? It may be time to consider gifting. We are watching for you. If you have an old will you should consider reviewing. It most likely is outdated.

+ We even had a session on the power of Social Media. If you are not using any type of Social Media, you better catch up with the times. People trust testimonials 90% but advertising 14%. Social media creates a testimonial "feeling."

+ Health Savings Accounts are a great way to reduce healthcare costs.

Monday, November 14, 2011

ACCOUNTANTS IN THE MOVIES

In Hollywood, accounting can seem like a pretty glamorous profession, or not.

In Hollywood, accounting can seem like a pretty glamorous profession, or not.Danny Glover played bow-tied accountant Henry Sherman in Wes Anderson's 2001 comedy, “The Royal Tenenbaums” about an eccentric family of upper-class misfits. Besides doing the accounting, Henry also romances the matriarch of the family, Etheline Tenenbaum, played by Anjelica Huston. Other members of the all-star cast included Gene Hackman, Ben Stiller, Gwyneth Paltrow, Bill Murray, Luke Wilson and Owen Wilson, along with the voice of narrator Alec Baldwin.

Saturday, November 12, 2011

FLAT TAX QUESTION

Not sure if you remember me, but I attended York College and had a few of your classes in '03-'05. With all of this "flat tax" talk by Presidential candidates right now, all I could think about was my classes where you would talk about that proposed flat tax that you said if it ever became law, instead of putting you out of business you'd have more business than before because it was so complex. Anyways, I was just curious what you thought about the current suggestions (Cain's 9-9-9 and Perry recent proposal-20% or normal, etc.). Thanks for listening!~ Samuel

A. Sam, sure I remember you. I hope all is going well. Looks like a nice accounting firm that you are with.

Regarding the 9-9-9 and Perry’s 20% Alternative I don’t see any way that those plans are anything other than campaign rhetoric. To start with, tax laws must originate in the House Ways and Means Committee not with the President. The last major tax legislation was in 1986 and that took over 2 years to get through Congress. And even with that, as people start studying the plans they realize that there is not enough money in the plan to make it work.

Oh yea… I forgot … “you can take away all the deductions but don’t take away my ________________ (fill in the blank -depreciation/charitable/tax exempt interest/child tax credit/medical expense etc.)

And don’t forget what I said in class, “people want fair and simple, but in reality that does not exist. Something can be simple but usually it is not fair so to make it fair we have to make it more complex.” Law of the universe.

Keep in touch.

Thursday, November 10, 2011

CHARITABLE CONTRIBUTIONS FROM IRAS

This year may well be the last chance for taxpayers age 70 1/2 or older to take advantage of an up-to-$100,000 annual exclusion from gross income for otherwise taxable individual retirement account (IRA) distributions that are qualified charitable distributions. Such distributions aren't subject to the charitable contribution percentage limits and aren't includible in gross income. This tax advantage will not be available for distributions made in tax years beginning after Dec. 31, 2011.

This is a great opportunity for taxpayers that do not have enough itemized deductions to file the “long form.” For married couples over age 65 the standard deduction is $13,900 and for singles it is $7,250.

Where this becomes a great planning tool is when the taxpayer is in the zone where they are paying tax of Social Security Benefits and making charitable contributions that they effectively can’t deduct because they are taking the standard deduction.

For example:

Bonnie and Clyde are both over age 70 ½. They have interest and other income of $20,000 and are taking $10,000 per year from their IRA. In addition they have Social Security benefits of $20,000. Bonnie and Clyde got religion after they retired from the banking business and annually make charitable contributions of $7,500.

If they draw money from their IRA and put it in their checking account and then make a charitable contribution their total federal and state tax is $1,703.

On the other hand if they direct their IRA administrator to take the IRA money of $7,500 and give it to their charity their tax drops to $176.

There is a saving so $1,527. Pretty cool… easier than robbing a bank.

If you need any more information on this let me know. Remember, unless Congress renews this tax strategy 2011 is your last chance. You might want to think about doing your 2012 contribution in 2011 to beat the expiration deadline.

Wednesday, November 9, 2011

SCHOOL UNIFORMS

Q. As a mom, I love school uniforms. They’re easy and predictable. What they aren’t is cheap. They’re also not in great demand for wear outside of school which means that they serve one purpose only. So that feels like an expense that should be deductible, right?

Q. As a mom, I love school uniforms. They’re easy and predictable. What they aren’t is cheap. They’re also not in great demand for wear outside of school which means that they serve one purpose only. So that feels like an expense that should be deductible, right? A. Sorry, nondeductible. The IRS does not allow deductions for school uniforms, even if required, for public, parochial or private schools.

The rules are a bit different at military school. If you are a student at an armed forces academy, you cannot deduct the cost of your uniforms – that’s consistent with the rules for public, parochial and private schools. However, you do get something of a break at military school in that you can deduct the cost of insignia, shoulder boards, and related items.

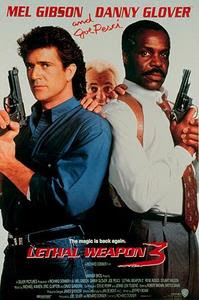

ACCOUNTANTS IN THE MOVIES

In Hollywood, accounting can seem like a pretty glamorous profession, or not.

In Hollywood, accounting can seem like a pretty glamorous profession, or not.Joe Pesci plays accountant Leo Getz, who is protected by cops Danny Glover and Mel Gibson after he become a witness against his money-laundering clients in three of the four "Lethal Weapon" action-comedy movies. Leo continually gets his bodyguards in trouble, but he seems to be having a lot more fun than doing the books. By the final movie, he went through a career change and became a private detective.

Tuesday, November 8, 2011

NOTIFY THE IRS IF YOU MOVE

The key point is that a notice or document sent to a taxpayer's “last known address” is legally effective even if the taxpayer never receives it.

Friday, November 4, 2011

U.S. SOCIAL SECURITY GOES "CASH NEGATIVE"

Wednesday, November 2, 2011

TANNING SALONS – THE TAX MAN COMETH

ACCOUNTANTS IN THE MOVIES

In Hollywood, accounting can seem like a pretty glamorous profession, or not.

In Hollywood, accounting can seem like a pretty glamorous profession, or not.The opening sequence in the 1983 comedy, "Monty Python's The Meaning of Life," is a short movie called "The Crimson Permanent Assurance," in which a group of beleaguered British chartered accountants decides to fight their corporate overlords by turning into pirates and sailing off on the high seas of accountancy. "It's fun to charter an accountant and sail the wide accountant-sea," the pirates sing.

Tuesday, November 1, 2011

SOCIAL SECURITY BENEFIT INCREASE FOR 2012

For more information on Social Security: Click Here