Friday, December 23, 2011

WHAT A MESS – PAYROLL TAX DEBATE

But here is the problem. In just a few days you we will writing the first 2012 paychecks and we don’t know how much we are going to withhold. The IRS publications are out without the cut and I am sure that the computer programmers are going to be burning the midnight oil once Congress and the President act. There is also a chance that the extension of the law may occur early in 2012 and be retroactive to January 1, 2012. We hope that this does not happen, but recent history shows there is a good chance of it occurring.

The primary issue for our employers is whether the payroll tax software that they use is timely updated for these changes. If a new law is passed either at the end of the this month or early next month, the software may not get updated for your first payroll. This may cause it to be wrong and changes will need to be performed to get the right amount of pay to your employees and report the right taxes on your form 943 at year-end or form 941 for the first quarter.

We will keep you posted.

CLEAN OUT THE CLOSETS

AND GET A TAX DEDUCTION

AND GET A TAX DEDUCTIONIf you itemize deductions (the long form) you not only can deduct your cash contributions but you can also deduct your non cash contributions. What we are talking about here is items given to the Salvation Army and the like. Remember the key is Documentation, Documentation, Documentation!

Here are the rules for non cash contributions:

First, make sure that this is a qualified charity. If in doubt ask to see their 501(c) approval.

Remember, no matter how charitable a contribution to an individual may be, contributions to individuals are not deductible.

If the contribution of goods is less than $250 you should have either a written acknowledgment from the charity of some other reliable list.

If the goods have a value between $250 and $500 then you need a written acknowledgement and, of course a list.

If between $500 and $5,000 then written acknowledgement; your list and a file a Form 8283 with the return.

If over $5,000 all of the above and you must file an appraisal with the return.

Wednesday, December 21, 2011

SIX YEAR-END TIPS TO REDUCE 2011 TAXES

The IRS wants to remind all taxpayers that with the New Year fast approaching, there is still time for you to take steps that can lower your 2011 taxes. However, you usually need to take action no later than Dec. 31 in order to claim certain tax benefits.

The IRS wants to remind all taxpayers that with the New Year fast approaching, there is still time for you to take steps that can lower your 2011 taxes. However, you usually need to take action no later than Dec. 31 in order to claim certain tax benefits. YEAR-END TAX PLANNING MOVES FOR BUSSINESSES & BUSINESS OWNERS

Year-End Tax-Planning Moves for Businesses & Business Owners

□ Businesses should consider making expenditures that qualify for the business property expensing option. For tax years beginning in 2011, the expensing limit is $500,000 and the investment ceiling limit is $2,000,000. And a limited amount of expensing may be claimed for qualified real property. However, unless Congress changes the rules, for tax years beginning in 2012, the dollar limit will drop to $139,000, the beginning-of-phase-out amount will drop to $560,000, and expensing won't be available for qualified real property. The generous dollar ceilings that apply this year mean that many small and medium sized businesses that make timely purchases will be able to currently deduct most if not all their outlays for machinery and equipment. What's more, the expensing deduction is not prorated for the time that the asset is in service during the year. This opens up significant year-end planning opportunities.

□ Businesses also should consider making expenditures that qualify for 100% bonus first-year depreciation if bought and placed in service this year. This 100% first-year write-off generally won't be available next year unless Congress acts to extend it. Thus, enterprises planning to purchase new depreciable property this year or the next should try to accelerate their buying plans, if doing so makes sound business sense.

□ If you are self-employed and haven't done so yet, set up a self-employed retirement plan.

□ Depending on your particular situation, you may also want to consider deferring a debt-cancellation event until 2012, and disposing of a passive activity to allow you to deduct suspended losses.

□ If you own an interest in a partnership or S corporation, you may need to increase your basis in the entity so you can deduct a loss from it for this year.

These are just some of the year-end steps that can be taken to save taxes.

Again, by contacting us, we can tailor a particular plan that will work best for you.

Tuesday, December 20, 2011

YEAR-END TAX PLANNING MOVES FOR INDIVIDUALS

Year-End Tax Planning Moves for Individuals

□ Increase the amount you set aside for next year in your employer's health flexible spending account (FSA) if you set aside too little for this year. Don't forget that you can no longer set aside amounts to get tax-free reimbursements for over-the-counter drugs, such as aspirin and antacids.

□ If you become eligible to make health savings account (HSA) contributions in December of this year, you can make a full year's worth of deductible HSA contributions for 2011.

□ Realize losses on stock while substantially preserving your investment position. There are several ways this can be done. For example, you can sell the original holding, and then buy back the same securities at least 31 days later. It may be advisable for us to meet to discuss year-end trades you should consider making.

□ Postpone income until 2012 and accelerate deductions into 2011 to lower your 2011 tax bill. This strategy may enable you to claim larger deductions, credits, and other tax breaks for 2011 that are phased out over varying levels of adjusted gross income (AGI). These include child tax credits, higher education tax credits, the above-the-line deduction for higher-education expenses, and deductions for student loan interest. Postponing income also is desirable for those taxpayers who anticipate being in a lower tax bracket next year due to changed financial circumstances. Note, however, that in some cases, it may pay to actually accelerate income into 2011. For example, this may be the case where a person's marginal tax rate is much lower this year than it will be next year.

□ If you believe a Roth IRA is better than a traditional IRA, and want to remain in the market for the long term, consider converting traditional-IRA money invested in beaten-down stocks (or mutual funds) into a Roth IRA if eligible to do so. Keep in mind, however, that such a conversion will increase your AGI for 2011.

□ If you converted assets in a traditional IRA to a Roth IRA earlier in the year, the assets in the Roth IRA account may have declined in value, and if you leave things as-is, you will wind up paying a higher tax than is necessary. You can back out of the transaction by recharacterizing the rollover or conversion, that is, by transferring the converted amount (plus earnings, or minus losses) from the Roth IRA back to a traditional IRA via a trustee-to-trustee transfer. You can later reconvert to a Roth IRA.

□ It may be advantageous to try to arrange with your employer to defer a bonus that may be coming your way until 2012.

□ Consider using a credit card to prepay expenses that can generate deductions for this year.

□ If you expect to owe state and local income taxes when you file your return next year, consider asking your employer to increase withholding of state and local taxes (or pay estimated tax payments of state and local taxes) before year-end to pull the deduction of those taxes into 2011 if doing so won't create an alternative minimum tax (AMT) problem.

□ Take an eligible rollover distribution from a qualified retirement plan before the end of 2011 if you are facing a penalty for underpayment of estimated tax and the increased withholding option is unavailable or won't sufficiently address the problem. Income tax will be withheld from the distribution and will be applied toward the taxes owed for 2011. You can then timely roll over the gross amount of the distribution, as increased by the amount of withheld tax, to a traditional IRA. No part of the distribution will be includible in income for 2011, but the withheld tax will be applied pro rata over the full 2011 tax year to reduce previous underpayments of estimated tax.

□ Estimate the effect of any year-end planning moves on the AMT for 2011, keeping in mind that many tax breaks allowed for purposes of calculating regular taxes are disallowed for AMT purposes. These include the deduction for state property taxes on your residence, state income taxes (or state sales tax if you elect this deduction option), miscellaneous itemized deductions, and personal exemption deductions. Other deductions, such as for medical expenses, are calculated in a more restrictive way for AMT purposes than for regular tax purposes. As a result, in some cases, deductions should not be accelerated.

□ Accelerate big ticket purchases into 2011 in order to assure a deduction for sales taxes on the purchases if you will elect to claim a state and local general sales tax deduction instead of a state and local income tax deduction. Unless Congress acts, this election won't be available after 2011.

□ You may be able to save taxes this year and next by applying a bunching strategy to “miscellaneous” itemized deductions, medical expenses and other itemized deductions.

□ If you are a homeowner, make energy saving improvements to the residence, such as putting in extra insulation or installing energy saving windows, and energy efficient heaters or air conditioners. You may qualify for a tax credit if the assets are installed in your home before 2012.

□ Unless Congress extends it, the up-to-$4,000 above-the-line deduction for qualified higher education expenses will not be available after 2011. Thus, consider prepaying eligible expenses if doing so will increase your deduction for qualified higher education expenses. Generally, the deduction is allowed for qualified education expenses paid in 2011 in connection with enrollment at an institution of higher education during 2011 or for an academic period beginning in 2011 or in the first 3 months of 2012.

□ You may want to settle an insurance or damage claim in order to maximize your casualty loss deduction this year.

□ If you are age 70- 1/2 or older, own IRAs and are thinking of making a charitable gift, consider arranging for the gift to be made directly by the IRA trustee. Such a transfer, if made before year-end, can achieve important tax savings.

□ Take required minimum distributions (RMDs) from your IRA or 401(k) plan (or other employer-sponsored retired plan) if you have reached age 70- 1/2. Failure to take a required withdrawal can result in a penalty of 50% of the amount of the RMD not withdrawn. If you turned age 70- 1/2 in 2011, you can delay the first required distribution to 2012, but if you do, you will have to take a double distribution in 2012—the amount required for 2011 plus the amount required for 2012. Think twice before delaying 2011 distributions to 2012—bunching income into 2012 might push you into a higher tax bracket or have a detrimental impact on various income tax deductions that are reduced at higher income levels. However, it could be beneficial to take both distributions in 2012 if you will be in a substantially lower bracket that year, for example, because you plan to retire late this year.

□ Make gifts sheltered by the annual gift tax exclusion before the end of the year and thereby save gift and estate taxes. You can give $13,000 in 2011 to each of an unlimited number of individuals but you can't carry over unused exclusions from one year to the next. The transfers also may save family income taxes where income-earning property is given to family members in lower income tax brackets who are not subject to the kiddie tax.

Again, by contacting us, we can tailor a particular plan that will work best for you.

Friday, December 16, 2011

1099 FORM LETTER TO YOUR VENDORS

Dear Vendor,

IRS regulation requires that we issue 1099 forms to certain companies and individuals. In order to accurately prepare these forms, IRS requires that we obtain and maintain form W-9 for all of our vendors.

Therefore, in order to ensure our reporting accuracy, please complete the enclosed form W-9 and return to us by mail or fax.

Thank you for your immediate attention to this matter.

Sincerely,

W-9 LINK

Thursday, December 15, 2011

W-9 WHAT ABOUT SENDING TO….

A. I would advise getting W-9’s from them. This will assure that you were not required to do backup withholding. The IRS has not been penalizing companies that do not have W-9’s but it technically is required. My guess is that someday this will be an issue. You just as well get ahead of the curve.

If they are not a corporation and they are providing services then a 1099 is in order. If they are just your supplier and you buy inventory, hard goods etc. then you do not need to do a 1099. Some taxpayers are unsure of the form of business of the companies that they are dealing with. The W-9 will solve that problem. At the same time if you are not sure there form of business it is okay to send a 1099. There is no penalty for sending to a corp.

Wednesday, December 14, 2011

IRS OFFERS TIPS FOR YEAR-END GIVING

If you itemize your deductions (long form), you can deduct charitable contributions. The IRS just published Tips for Year-End Giving that you might want to review.

If you itemize your deductions (long form), you can deduct charitable contributions. The IRS just published Tips for Year-End Giving that you might want to review.CLICK HERE

Monday, December 12, 2011

DON’T FORGET YOUR FLEXIBLE SPENDING MONEY

Check your flexible spending account balance. You must clean it out by Dec. 31 if your employer still has not adopted the 2½-month grace period that IRS now permits. Otherwise, any money remaining in your account is forfeited. When you are deciding how much you should put into your flex plan for 2012, remember that a $2,500 annual cap on FSA payins is set to go into effect in 2013.

Check your flexible spending account balance. You must clean it out by Dec. 31 if your employer still has not adopted the 2½-month grace period that IRS now permits. Otherwise, any money remaining in your account is forfeited. When you are deciding how much you should put into your flex plan for 2012, remember that a $2,500 annual cap on FSA payins is set to go into effect in 2013.

Friday, December 9, 2011

WHO MUST ISSUE 1099-MISCs

First of all you just need to do a 1099 for certain business expenses.

o For example, someone paints your personal residence and charges you $1,100 you do not have to give that person a 1099. On the other hand if that person should paint your business property and charged you $1,100 you would give that person a 1099 for $1,100

You just have to issue a 1099 for services, not for tangible business purchases

o If the painter gives you a bill for painting and the bill includes labor and the cost of paint you would still give the painter a 1099 for the whole purchase

You do not need to give a 1099 to a corporation

o Both C corporation and S corporations qualify

o You must give a 1099 to LLC’s and partnerships

You just need to give a 1099 if you pay over $600 during the year

o For example the painter paints your business in January and charges you $400 then later in the year you bring them back and he does another $500 of painting. The total is over $600 so you must give the person a 1099

There is no penalty for sending a 1099 to a corporation so if in doubt play it safe and send. Of course there are more rules but these are the basics ones.

Thursday, December 8, 2011

ONLY IN AMERICA

A fugitive who took a Kansas couple hostage in their home is suing them for $235,000. Accused murderer Jesse Dimmick claims Jared and Lindsay Rowley accepted his knifepoint offer of money to hide in their house. But the Rowleys later breached their "oral contract" by escaping as he slept, Dimmick says, "resulting in my being shot in the back by authorities."

A fugitive who took a Kansas couple hostage in their home is suing them for $235,000. Accused murderer Jesse Dimmick claims Jared and Lindsay Rowley accepted his knifepoint offer of money to hide in their house. But the Rowleys later breached their "oral contract" by escaping as he slept, Dimmick says, "resulting in my being shot in the back by authorities."Wow only in America!

Wednesday, December 7, 2011

SALON SOFTWARE REPLACING QUICKBOOKS

Q. I am thinking about getting rid of my QuickBooks and using my salon software for my P&L, general ledger and accounts payable. My salon software has a great deal on it right now. What do you think about this?

Q. I am thinking about getting rid of my QuickBooks and using my salon software for my P&L, general ledger and accounts payable. My salon software has a great deal on it right now. What do you think about this? A. It just doesn't work well~ the softwares are for two different purposes. Plus they are a good checks and balance for each other. BUT I believe you still need professional assistance in interperting your financial statements and sometimes your salon reports. I can't count the number of people who have made expenseive mistakes because they did not have good data.

For example, I can buy a Flowbee to cut my hair at home. But I will end up going to a professional for help. The same goes for your accounting - you need a professional. Wouldn't I have better looking haircut if I had seen you first?

Remember you can manage what you can measure and if all you have is garbage, it will pile up quickly.

Monday, December 5, 2011

2012 STANDARD MILEAGE RATES

Beginning on Jan. 1, 2012, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

• 55.5 cents per mile for business miles driven

• 23 cents per mile driven for medical or moving purposes

• 14 cents per mile driven in service of charitable organizations

The rate for business miles driven is unchanged from the mid-year adjustment that became effective on July 1, 2011. The medical and moving rate has been reduced by 0.5 cents per mile.

The standard mileage rate for business is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs as determined by the same study. Independent contractor Runzheimer International conducted the study.

You do have the option of calculating the actual costs of using your vehicle rather than using the standard mileage rates.

Saturday, December 3, 2011

QUESTION FROM A MISCLASSIFIED WORKER

A. Yes there is something you can do to cut your Social Security and Medicare in half. Since 2007, you are allowed to file a Form 8919M Uncollected Social Security and Medicare Tax on wages instead of filing Schedule SE. The form SE charges you tax at 15.3% versus the 7.65%.

There are some codes on the form that you will need to review and if you meet one of the criteria, walla you qualify.

By the way, this IRS may be visiting your employer. He will at least be getting a bill from the IRS for his 1/2.

Friday, December 2, 2011

HARSH 1099 PENALTIES

The IRS wants everyone to issue 1099's so that they can spot unreported income. This year the penalty for failure to file a 1099 is $250 per form with an addition $250 per form if you did not act in good faith.

The IRS wants everyone to issue 1099's so that they can spot unreported income. This year the penalty for failure to file a 1099 is $250 per form with an addition $250 per form if you did not act in good faith.I can guarantee you that one of the first things that the IRS looks at during the audit is 1099's. It is easy money for them if you did not file.

Think about it. If you missed 10 forms for three years the penalty would be $7,500 minimum with it possibly going to $15,000. That is on just 10 missed forms. Do the math. Make sure you issue 1099's.

Wednesday, November 30, 2011

1099K - PAYPAL & AMAZON

A. The best I can tell is that the credit card and debit card companies, including PayPal, will be sending out 1099K's with copies going to the IRS. Apparently the IRS will not be able to match so they are saying put 0 in the box.

As far as a link, I will look. I actually heard this at the Washington Tax Conference.

Tuesday, November 29, 2011

HIP TO BE SQUARE

Have you seen the new Square credit card app?

Have you seen the new Square credit card app? We use it when we are on the road to ring up credit card sales. It is really handy.

Developed by Twitter founder Jack Dorsey, this app allows merchants to accept credit cards via a small, square swiping device that plugs right into an iPhone or Android device. The only charge is a 2.75% transaction fee on every purchase.

In May they launched a new program called Square Register, a free iPad app that acts as a complete point of sale system for businesses It manages inventory and runs sales analytics. I have not used this software.

Here is how the software works. The customer swipes their cards on the Square card-reading device and sign their name directly on the screen of the iPad. They receive an email or text message receipt.

Customers with smart phones can download an app called Square Card Case, which allows them to set up and keep a tab with the merchant. When a customer activates the app and makes a purchase, his or her name appears on the merchant's iPad, and the merchant charges the account. The transaction is done completely over the iPad and the phone.

How long before a young person asks you "what was that stuff called cash that you used to use?"

ACCOUNTANTS IN THE MOVIES

In Hollywood, accounting can seem like a pretty glamorous profession, or not.

In Hollywood, accounting can seem like a pretty glamorous profession, or not.Ben Kingsley played compassionate accountant Itzhak Stern in the Oscar-winning 1993 Steven Spielberg movie, "Schindler's List." Stern was a real-life accountant who worked for German industrialist Oskar Schindler, played by Liam Neeson. The accountant typed and maintained the list of names of his fellow Jews who were hired to work in Schindler's factories, preventing them from being sent to the Nazi death camps. The real Itzhak Stern appeared in the movie, along with the surviving people on Oskar Schindler's real-life list.

Thursday, November 24, 2011

HAPPY THANKSGIVING

Thanksgiving Day brings to mind

the blessings in our lives

that usually go unnoticed:

a home that surrounds us

with comfort and protection;

delicious food, for pleasure

in both eating and sharing;

clothes to snuggle up in,

books and good entertainment

to expand our minds;

and freedom to worship our God.

Most of all we are thankful

for our family and friends,

those treasured people

who make our lives extra special.

You are part of that cherished group.

On Thanksgiving, (and every day)

we appreciate you.

Happy Thanksgiving

From Kopsa Otte

Wednesday, November 23, 2011

NEW ADDITION

Megan had a beautiful little girl yesterday.

7lbs 8oz. and 20 inches long

Tuesday, November 22, 2011

ACCOUNTANTS IN THE MOVIES

In Hollywood, accounting can seem like a pretty glamorous profession, or not.

In Hollywood, accounting can seem like a pretty glamorous profession, or not.Jack Lemmon plays an accountant in the 1954 comedy "Phffft!" who decides to split with wife Judy Holliday after eight years of marriage. He met her while doing her taxes, and even after they break up and start seeing other partners, he continues to keep her as a client. The unusual title is supposed to be the sound of a marriage losing steam. Lemmon also played an accountant in Billy Wilder's 1960 comedy, "The Apartment," in which he lends his apartment to boss Fred MacMurray for assignations with girlfriend Shirley Maclaine. The movie was later the basis of the musical "Promises, Promises."

Monday, November 21, 2011

529 PLAN FOR COLLEGE

A. It was great to visit with you at your pretax appointment. Here is some more information about 529 Plans.

Saturday, November 19, 2011

FICA TAX ON TIPS

A new program has been announced by IRS that uses data from employees' Forms 4137, Social Security and Medicare Tax on Unreported Tip Income, to determine the employer's share of FICA taxes on unreported tips.

A new program has been announced by IRS that uses data from employees' Forms 4137, Social Security and Medicare Tax on Unreported Tip Income, to determine the employer's share of FICA taxes on unreported tips.Employees use Form 4137 to report and pay their share of Social Security and Medicare taxes (FICA taxes) on tips that they did not report to their employer.

The IRS believes that employers in industries where tipping is common know that they must pay the employer's share of FICA taxes on tips that employees report to them. However, IRS feels that many employers do not realize that they may be liable for these taxes on tips employees do not report to them.

Employers are subject to FICA tax on unreported tips. An employer's liability for its share of the FICA taxes on unreported tips does not arise until it receives a Notice and Demand from IRS which instructs the employer to include the FICA taxes shown on the notice and demand on the employer's next Form 941, Employer's Quarterly Federal Tax Return. An employer will not be subject to any interest charges or deposit penalties if it properly reports the taxes as instructed in the notice and demand, and remits the tax due with its Form 941, or if it timely makes a deposit that is required to be made in accordance with the notice instructions.

In the past, IRS issued notice and demands based on tip audits using estimates, including data from Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips. Under the new initiative, the Notice and Demand will be based on information that IRS collects from employees' Forms 4137.

IRS generally intends to notify an employer at least 30 calendar days in advance of the issuance of a Notice and Demand by issuing a pre-notice. IRS has a designated staff to help resolve any discrepancies that are noted by employers on the pre-notice.

Observation: I have yet to see any of these new notices. If by chance you were unlucky enough to receive one please let me know. I am interested on how the IRS is actually handling this.

Tuesday, November 15, 2011

WASHINGTON D.C. UPDATE PART #4

- If you are under 55 and they made no changes to the law so you can expect to receive 77% of the benefits that you normally would be eligible for; if you are over 55 you should receive 100% of the benefits.

- To fix the program Congress needs to do one of two things, or some combination:

Increase income from payroll taxes by 17%

Reduce current benefits by 14%

- Social Security was never meant to provide 100% of the living expenses for retired individuals.

- 80 million baby boomers will be eligible for Social Security in the next 10 years.

- As a cost cutting measure the Social Security Administration has quit sending out the annual Social Security Statements that you normally received around you birthday. They are going to be providing the information on line, but they can't figure out how they are going to do that. Make sure you keep your last statement.

- Right now if you retire at age 62 versus age 65 you will get 75% of full benefits. The decision depends on your individual circumstances.

- The Social Security system is not a "the more you pay in the more you get." The lower 30% get much more than they pay in and more than the higher 70%.

WASHINGTON D.C. UPDATE PART #3

The IRS now can request backup copies of your software.

This is going to give them access to entries not only to your books but also it will allow the auditor to look at adjustments and changes that were made to your books by looking at the audit trail.

This is concerning. Think about yearend adjustments that are made when cleaning up the books and then when doing tax planning. The auditor is going to see those changes and will be asking questions.

Here is an example: Assume the owner of the business takes money from the business during the year. The bookkeeper classifies this as a loan. After the yearend we are looking at the transactions and determine that this actually should have been a dividend. On March 1st of the subsequent year we either make an entry or reclassify the check. The auditor is going to know about the entry through the audit function and think that we are doing some "hankie pankie" post yearend planning.

Here are some of the questions and answers addressed by the panel from the IRS:

Q. Is this legal?

A. Yes. We have been to court several times and in all cases the judge has ruled that we should have access to the electronic books because they are the books of original entry.

Q. Could we turn off the audit function?

A. Yes but that would make us suspicious and would probably extend the audit. What are you trying to hide?

Q. What if the client uses QuickBooks as a checkbook and then the accountant takes the QuickBooks and makes entries. Can they still request?

A. Yes

Q. If the auditor has the books can he look at prior years? If he is looking at prior years he is supposed to open an audit for those years. Will they be looking at those years?

A. We have told the auditors during training not to look at prior years.

Q. HERE WAS MY QUESTION. Many clients have point of sale software that keeps track of transactions and inventory along with accounts receivable but is not downloaded into the general ledger. Is this type of software subject to review?

A. Yes. This is considered part of the books of original entry and is subject to request.

Q. What if the electronic books are kept by the accountant. Can they still be requested or subpoenaed?

A. Yes.

Because of this new initiative by the IRS we are going to have to be more diligent in our recording into QuickBooks and other electronic software and be prepared to answer questions of why entries were made to change or to make journal entries after the end of the business year.

WASHINGTON D.C. UPDATE PART #2

I spoke with the Commissioner of the Small Business about the frustration that salon owners have with employees going to booth rental. I gave him my card and he said he would check this out and get back to me. I will keep you posted on what I hear back from him.

Independent contractors are on the radar.

There is a new initiative to have owners that are improperly treating workers to come forward and admit their mistake. The cost would be penalty of 10% of the payroll tax due for the prior 12 months. This is an effort by the IRS to allow businesses to get it right before they start a hard clamp down on worker classification.

The IRS is now doing an extensive study sampling worker classification

Estimates are that $64 billion is being lost in payroll taxes by misclassification.

Hard lobbying in Washington to eliminate the Section 530 Relief.

Efforts by the IRS to find employers that are improperly classifying workers:

- Independent research study on the issue

- New IRS specialist to help field auditors with the issue

- More exams

- 1099/W-2 comparisons within individual industries

- Working with the states on classification. States are getting much more active.

- Flagging businesses with more than 5 1099's showing more than $20,000; thus indicating the use of independent contractors and workers.

WASHINGTON D.C. UPDATE PART #1

I wanted to share with you some highlights. This is really important because future tax policy is going to hit us right in our bank account. With taxes scheduled to increase substantially and with the economy waning the more we know the better we can plan.

Here is Part #1 of this 2 1/2 day conference:

+ Nobody can outguess what Congress is going to do. Even the 'insiders' are concerned about the lack of direction.

+ We are fairly safe in planning for 2012. It is an election year so we won't see a lot of major changes. But in 2013 the Bush/Obama laws will be phased out and it is going to be a battle. If the past is any indication we may not know what the 2013 laws will be until late in the year. This is going to make planning in 2012 very important.

+ In 2011 we can take 100% write-off on certain leasehold improvements. This is scheduled to reduce to 50% in 2012 and then disappear in 2013. With the economy as it is we may see the ability to take 100% continue thru 2012- there is a chance but don't count on it. We are watching this for you.

+ The same is true with the write off of equipment. It reduces from $500,000 this year to $139,000 in 2012. This may also be extended. We are watching for you.

+ Many business owners are planning/hoping that Obama Care will be repealed. One of the Congressmen that spoke said that in his opinion it will not be repealed no matter who wins the White House. The Congressmen’s thinking is that it would take 60 Senators to overturn the bill and that will not happen.

+ The extremely high tax rates for people making over $200,000 are getting closer. With the exit of the Bush/Obama cuts; the Obama proposal to raise taxes on those wealthy people making over $250,000; and Obama Care laws tax increases for Medicare coming in 2014 rates could go as high as 43.4%. Plus we still have Social Security and State taxes ~ Ouch.

+ Everything is now political. It used to be a few years back that the leaders from the two parties would get together to work out solutions to problems. This does not happen anymore.

+ Estate planning is a mess. In 2011 and 2012 you can have an estate of $5 million and no estate tax. Any of the $5 million that you do not use you can pass to your spouse. In addition you can give $5 million. But in 2013 the estate drops to $1 million. Who knows how to plan? It may be time to consider gifting. We are watching for you. If you have an old will you should consider reviewing. It most likely is outdated.

+ We even had a session on the power of Social Media. If you are not using any type of Social Media, you better catch up with the times. People trust testimonials 90% but advertising 14%. Social media creates a testimonial "feeling."

+ Health Savings Accounts are a great way to reduce healthcare costs.

Monday, November 14, 2011

ACCOUNTANTS IN THE MOVIES

In Hollywood, accounting can seem like a pretty glamorous profession, or not.

In Hollywood, accounting can seem like a pretty glamorous profession, or not.Danny Glover played bow-tied accountant Henry Sherman in Wes Anderson's 2001 comedy, “The Royal Tenenbaums” about an eccentric family of upper-class misfits. Besides doing the accounting, Henry also romances the matriarch of the family, Etheline Tenenbaum, played by Anjelica Huston. Other members of the all-star cast included Gene Hackman, Ben Stiller, Gwyneth Paltrow, Bill Murray, Luke Wilson and Owen Wilson, along with the voice of narrator Alec Baldwin.

Saturday, November 12, 2011

FLAT TAX QUESTION

Not sure if you remember me, but I attended York College and had a few of your classes in '03-'05. With all of this "flat tax" talk by Presidential candidates right now, all I could think about was my classes where you would talk about that proposed flat tax that you said if it ever became law, instead of putting you out of business you'd have more business than before because it was so complex. Anyways, I was just curious what you thought about the current suggestions (Cain's 9-9-9 and Perry recent proposal-20% or normal, etc.). Thanks for listening!~ Samuel

A. Sam, sure I remember you. I hope all is going well. Looks like a nice accounting firm that you are with.

Regarding the 9-9-9 and Perry’s 20% Alternative I don’t see any way that those plans are anything other than campaign rhetoric. To start with, tax laws must originate in the House Ways and Means Committee not with the President. The last major tax legislation was in 1986 and that took over 2 years to get through Congress. And even with that, as people start studying the plans they realize that there is not enough money in the plan to make it work.

Oh yea… I forgot … “you can take away all the deductions but don’t take away my ________________ (fill in the blank -depreciation/charitable/tax exempt interest/child tax credit/medical expense etc.)

And don’t forget what I said in class, “people want fair and simple, but in reality that does not exist. Something can be simple but usually it is not fair so to make it fair we have to make it more complex.” Law of the universe.

Keep in touch.

Thursday, November 10, 2011

CHARITABLE CONTRIBUTIONS FROM IRAS

This year may well be the last chance for taxpayers age 70 1/2 or older to take advantage of an up-to-$100,000 annual exclusion from gross income for otherwise taxable individual retirement account (IRA) distributions that are qualified charitable distributions. Such distributions aren't subject to the charitable contribution percentage limits and aren't includible in gross income. This tax advantage will not be available for distributions made in tax years beginning after Dec. 31, 2011.

This is a great opportunity for taxpayers that do not have enough itemized deductions to file the “long form.” For married couples over age 65 the standard deduction is $13,900 and for singles it is $7,250.

Where this becomes a great planning tool is when the taxpayer is in the zone where they are paying tax of Social Security Benefits and making charitable contributions that they effectively can’t deduct because they are taking the standard deduction.

For example:

Bonnie and Clyde are both over age 70 ½. They have interest and other income of $20,000 and are taking $10,000 per year from their IRA. In addition they have Social Security benefits of $20,000. Bonnie and Clyde got religion after they retired from the banking business and annually make charitable contributions of $7,500.

If they draw money from their IRA and put it in their checking account and then make a charitable contribution their total federal and state tax is $1,703.

On the other hand if they direct their IRA administrator to take the IRA money of $7,500 and give it to their charity their tax drops to $176.

There is a saving so $1,527. Pretty cool… easier than robbing a bank.

If you need any more information on this let me know. Remember, unless Congress renews this tax strategy 2011 is your last chance. You might want to think about doing your 2012 contribution in 2011 to beat the expiration deadline.

Wednesday, November 9, 2011

SCHOOL UNIFORMS

Q. As a mom, I love school uniforms. They’re easy and predictable. What they aren’t is cheap. They’re also not in great demand for wear outside of school which means that they serve one purpose only. So that feels like an expense that should be deductible, right?

Q. As a mom, I love school uniforms. They’re easy and predictable. What they aren’t is cheap. They’re also not in great demand for wear outside of school which means that they serve one purpose only. So that feels like an expense that should be deductible, right? A. Sorry, nondeductible. The IRS does not allow deductions for school uniforms, even if required, for public, parochial or private schools.

The rules are a bit different at military school. If you are a student at an armed forces academy, you cannot deduct the cost of your uniforms – that’s consistent with the rules for public, parochial and private schools. However, you do get something of a break at military school in that you can deduct the cost of insignia, shoulder boards, and related items.

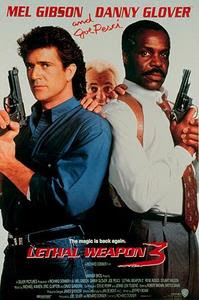

ACCOUNTANTS IN THE MOVIES

In Hollywood, accounting can seem like a pretty glamorous profession, or not.

In Hollywood, accounting can seem like a pretty glamorous profession, or not.Joe Pesci plays accountant Leo Getz, who is protected by cops Danny Glover and Mel Gibson after he become a witness against his money-laundering clients in three of the four "Lethal Weapon" action-comedy movies. Leo continually gets his bodyguards in trouble, but he seems to be having a lot more fun than doing the books. By the final movie, he went through a career change and became a private detective.

Tuesday, November 8, 2011

NOTIFY THE IRS IF YOU MOVE

The key point is that a notice or document sent to a taxpayer's “last known address” is legally effective even if the taxpayer never receives it.

Friday, November 4, 2011

U.S. SOCIAL SECURITY GOES "CASH NEGATIVE"

Wednesday, November 2, 2011

TANNING SALONS – THE TAX MAN COMETH

ACCOUNTANTS IN THE MOVIES

In Hollywood, accounting can seem like a pretty glamorous profession, or not.

In Hollywood, accounting can seem like a pretty glamorous profession, or not.The opening sequence in the 1983 comedy, "Monty Python's The Meaning of Life," is a short movie called "The Crimson Permanent Assurance," in which a group of beleaguered British chartered accountants decides to fight their corporate overlords by turning into pirates and sailing off on the high seas of accountancy. "It's fun to charter an accountant and sail the wide accountant-sea," the pirates sing.

Tuesday, November 1, 2011

SOCIAL SECURITY BENEFIT INCREASE FOR 2012

For more information on Social Security: Click Here

Monday, October 31, 2011

REVOKED WORK CLOTHING DEDUCTIONS

As I am sure you are aware, work clothes are not deductible unless it is a uniform. Furthermore, clothes that are suitable for wear on the street are not deductible. Therefore, for example, even though you are required to wear black at work, since the clothes are acceptable in public they are not deductible.

Earlier this year, I thought maybe the IRS was going to give us a break. They ruled that a city could provide one set of clothes for their street workers. Their rational was that this was a "de minimus" fringe. What that means in general is that the cost was minimal and therefore the cost to track would not be worth the effort. An example of de minimus would be coffee and rolls that you provide for staff.

I thought that if this works for city why it wouldn’t work for salons and spas.

Bad news- the IRS changed their mind.

Without much by way of explanation, IRS has revoked the earlier ruling which allowed employees to exclude the value of employer-provided clothing and related accessories from their taxable income as a de minimis fringe benefit.

So if you heard from me or others that you might have a new deduction the IRS has pulled it back.

THE IOWA PUMPKIN TAX REPEALED

Here is how stupid taxes can be. It is estimated that more 750 million pumpkins are carved into jack o' lanterns each October. While the practice brings joy to many, it created heartburn for Iowa tax officials four years ago, who were dismayed that so many people were decorating their pumpkins.

Here is how stupid taxes can be. It is estimated that more 750 million pumpkins are carved into jack o' lanterns each October. While the practice brings joy to many, it created heartburn for Iowa tax officials four years ago, who were dismayed that so many people were decorating their pumpkins. You see, Iowa (like most states) taxes retail sales but exempts groceries. Pumpkins used for decoration should have been taxed but were slipping by because they were also food. So they spent taxpayer’s money sending out a bulletin to retailers reminding them to quiz customers on whether they were buying the pumpkin to eat (not taxable) or decorate (taxable):

Pumpkins: Pies and jack-o'-lanterns

The Department recently refined its position on whether pumpkins are subject to Iowa sales tax to more closely match what we believe to be their predominant use.

In the past, pumpkins were exempt from sales tax as a food (edible squash), even if they were to be later made into jack-o'-lanterns or used as decorations.

Our position now is that pumpkins are taxable if:

1. They are advertised to be used as jack-o'-lanterns/decorations, or

2. It is understood that they will be used as jack-o'-lanterns/decorations

Pumpkins are exempt in the following circumstances:

* The buyer completes a sales tax exemption certificate stating they will be used as food, or

* The pumpkins are a specific variety used to make pumpkin pies and are advertised in that way, or

* They are purchased with Food Stamps.

Retailers who sell pumpkins should keep these guidelines in mind and make any necessary changes to their tax treatment of pumpkin sales.

Fortunately this got picked up by the media and then the blogosphere,, which led to local news coverage, and finally Iowa officials rescinded the pumpkin tax a few days later. One less silly tax.

Friday, October 28, 2011

ACCOUNTANTS IN THE MOVIES

In Hollywood, accounting can seem like a pretty glamorous profession, or not.

In Hollywood, accounting can seem like a pretty glamorous profession, or not.Edmund O'Brien plays accountant Frank Bigelow in the fast-paced 1950 film noir crime drama "D.O.A." The movie opens with Bigelow entering a police station to report his own homicide and then in flashback traces how he came to learn that he had been poisoned by a former client who needed him to notarize an incriminating document. The movie was later remade in 1988 with Dennis Quaid playing O'Brien's role, but in the remake Quaid is a college professor. O'Brien is shown here with Laurette Luez, who plays his client's mistress Marla Rakubian.

Thursday, October 27, 2011

BRITAIN'S BARBERSHOPS BOOMING

From The Economist: BEHIND curlicues of cigarette smoke and with the gentle tones of wartime tunes wafting from a tape deck, Alf Biber is back on his feet after the looting of his dinky Tottenham barbershop (above). His eyes twinkle as he praises the properties of witch-hazel and displays a set of antique razors. In his youth Mr Biber could trim up to 80 heads a day; aged 89, he now keeps busy with 20 a week.

Mr Biber’s craft is enjoying a British renaissance. About 10% of the nation’s 35,000-odd hair salons are now barbers; a new association sprang up last year to help them. The number of listed barbers has more than doubled since 2001, with a 32% increase in the past three years alone. Insiders say cheap and burly shearers did well in the recession, as cash-strapped customers cut back on frippery. The no-nonsense Turkish barbers who have popped up in North London point to the profession’s popularity among migrants. (In Britain, unlike in America and much of Europe, barbers do not need a licence.)

The fancy end of the trade is blossoming, too. Josh Gibson, principal of a Vidal Sassoon hairdressing academy in London, says his barbering course is the fastest growing of those on offer. L’Oréal, a big French beauty company, reckons the British market for men’s grooming gear is growing twice as fast as that for women’s. At Taylor of Old Bond Street, a swanky London barber and boutique, sales to other British retailers were up by 72% last year. It offers fragrant salves sporting names such as “Bay Rum”, and swish shaving brushes with bristles of Chinese badger fur.

What lies behind this growth? Caroline Cox, a fashion historian and consultant, puts it down to a return to old-fashioned masculinity in response to economic uncertainty. “If we worry about the future, we take refuge in the past,” she says. If men are indeed trying to regain the quintessence of their sex, then barbershops fit the bill. “It’s a bit of a club atmosphere in here,” says Barry Klein, director of the Taylor boutique.

Barbers have come a long way since the days when they pulled teeth and therapeutically bled their clients—a practice thought to explain the traditional red-and-white striped pole, a reference to bloodied bandages. Barbering bigwigs worry that the lack of compulsory licensing in Britain keeps standards down and gives the craft a bad name. But the broader appetite for government regulation is at a low ebb, and the reputation of barbers seems to be doing fine it in its absence. No need to get in a lather, then.

Wednesday, October 26, 2011

SOCIAL SECURITY WAGE BASE INCREASES

For those of you that are budgeting, the IRS has released the new base for Social Security tax. If you are at max this will mean an additional $205 tax ($3,300 x .062). For self employed double that.

The Social Security Administration has announced that the wage base for computing the Social Security tax (OASDI) in 2012 increases to $110,100 from $106,800, which was the wage base for 2009 through 2011. The $3,300 increase, which is about 3%, is due to an increase in average total wages.

Tuesday, October 25, 2011

MONEY OPPORTUNITY - YOU CAN BE THE FIRST

PRISONERS BILK TAXPAYERS OUT OF MILLIONS

I’m not sure what I think the real purpose of jail is but I’m pretty sure it’s not supposed to be a forum for committing more crimes. And yet, that’s what’s allegedly happening in jails across the country.

CNN recently reported that an investigation into a scheme into a Key West, Florida has found attempts to cheat the government out of more than $1 million – on your dime. Investigators believe that inmates have been filing false tax forms using bogus Social Security numbers and made up businesses in order to collect refund checks. Instructions explaining how to fill out the forms together with cheat sheets – as well as how to keep refund request relatively low (under $5,000) – were circulated among the prisoners in a far-reaching scheme.

Most commonly, prisoners would fill out a form 4852, a form that you use to report wages when your form W-2 is missing. When the forms, along with tax returns were processed, the prisoners received bogus refunds. The refunds were mailed to family members and sometimes, even directly to the prison. At the prison, the refunds were divided among ringleaders (who kept a portion for themselves) and participants in the scheme. Genius, right?

It may not be as genius as it sounds. The scheme is actually nothing new: it’s been happening for years. The IRS has been notified and across the country, charges have been filed and ringleaders prosecuted. However, officials familiar with these cases say that the fraud is ongoing. At Key West, for example, the prison has been intercepting bogus checks still being issued by the IRS for at least one prisoner.

The IRS, for its part, says that it is aware of what’s happening. They note that it is difficult to attack the problem since being in prison doesn’t bar taxpayers from receiving a genuine refund. Even more challenging? The population of prisons is constantly changing which means that patterns may be difficult to spot.

The issue has been on the radar for years. Five years ago, the IRS flagged false refunds from prisoners as a top concern noting that of 118,000 fraudulent tax returns filed, 18,000 were filed by prisoners – that’s a whopping 15%. Prisoners received more than $14 million in bogus claims, though the IRS points out that they successfully blocked an additional $53 million.

The IRS won’t say what steps they are taking to control the number of bogus claims filed by prisoners but they do know who is to blame: you. Reportedly IRS’ position is to issue refunds and then audit later in response to a bigger problem: taxpayers want their refunds quickly. Increased scrutiny of returns at the processing level (while clearly more efficient) would slow down the refund process. And that wouldn’t be popular for taxpayers who want to see refunds.

Saturday, October 22, 2011

WILLA VS WELLA

Procter & Gamble were all set to take a Connecticut housewife to court over her use of the name Willa for a range of pre-teen skin care products, claiming it sounded too much like its brand Wella. However, the housewife is victorious following an out-of-court settlement. Earlier this year Christy Prunier received a cease and desist letter from P&G, which claimed that the product branding, packaging and name were too similar to a range of products being marketed under its Wella hair care range. P&G lawyers claimed that the similarities would lead to confusion amongst its established customer base for the brand because of the the two ranges could be mistaken for one another on retail shelves.

Product range named after 11-year old daughter.

Prunier had spent three years developing the product, which was named after her own 11-year old daughter, and had obtained trademark approval from the US government at the beginning of the year, allowing her to put the complete range to market. However, in a classic David and Goliath story line, the roll-out of the natural-based product line, which includes skin care products and a lip balm, was stalled as the two companies readied for battle. The two were due to face one another in court in Manhattan, New York City last week, but as the media attention gathered, in turn drumming up a clear sympathy for the ‘little guy’, P&G chose to settle out of court.

Friday, October 21, 2011

NO WONDER WE HAVE A DEFICIT

In 2009 42%

Now 51%

(Tax Foundation) -- The Tax Foundation's Tax Policy Blog reports that from 1969 to 2009, U.S. taxpayers who have a zero or negative tax liability grew from less than 20% of all filers to 42%, according to the IRS. Congress' Joint Committee on Taxation has "found that 51% of American households paid no income taxes." For millions of these non-payers, "the refundable credits more than exceed their payroll tax contributions." The blog also notes that since 2003, the top 1% of taxpayers' share of the tax burden "has well exceeded that of the bottom 90%, even during the recent recession."

Wednesday, October 19, 2011

MAN AGAINST MACHINES

A couple of years ago, I was making a presentation to a group of about 250 CPA’s, Certified Public Accountants. Before the talk I was back stage with one of the other presenters. This guy was from one of the big CPA firms and had just returned from working in Europe for one of his tax clients.

During my conversation I asked him about technology in Europe. In his words, “Europe has not embraced technology because it doesn’t do them any good.” It seems that In Europe you can’t lay anybody off so there is no incentive to use computers when they still need to have the people there. I was thinking about that conversation recently as I watched six or seven workers outside my office window tearing up a street and laying new cement. There weren’t many workers walking around with shovels, they were utilizing big machines and technology to build the new road. Anything that needed to be moved was done with a backhoe or a frontend loader. I don’t think I ever saw over ten workers and that was when they were pouring cement. So even “shovel ready” jobs are not going to create a lot of jobs unless they mandate that everything be done by hand.

Actually President Obama was right when he said that ATM’s were part of the employment problem. You don’t need tellers if people are using ATM’s.

Recently I read in Reuters that since 1999 business investment in equipment and software has surged 33% while the total number of people employed by private firms (not the government) has changed very little. The gap between man and machine widened even further in 2008 and 2009 during the recession. You can see why the United States is struggling to bring down employment which is stuck at 9%. I know my clients that went through the 2008 and 2009 recession have not significantly increased their number of employees because they are able to get by with the people they have.

Here is a personal example: I know that in our small accounting office we have 20 to 25 people employed depending on the time of year. I estimate that if we did not have computers and software and two or three monitors on everybody’s desk and internet access, etc. we would need fifty to seventy-five people to do the same amount of work we are doing right now. We used to have one person who worked part-time, just updating our paper tax library. Right now our tax library is out on the cloud and we don’t need that person working part-time. The same is true with our mail room and our filing. Everything is electronically filed.

I guess this is progress and we have to wait for the workforce to get caught up to the progress. I think we can see that it’s more than just the economy that is causing the problem with unemployment.

ACCOUNTANTS IN THE MOVIES

Charles Martin Smith (far right) played accountant Oscar Wallace in the 1987 movie version of "The Untouchables," a popular TV series that ran from 1959-1963. Wallace joins a team organized by Treasury agent Elliot Ness, played by Kevin Costner, to break up Al Capone's mob in Prohibition-era Chicago. They finally put Capone behind bars for tax evasion. Capone was played by Robert De Niro. Other members of Ness's Untouchables included Sean Connery and Andy Garcia. Wallace was based on a real-life accountant named Frank J. Wilson who joined the Treasury Department's Intelligence Unit in 1920 and later helped nab Lindbergh baby kidnapper Bruno Hauptmann by insisting that the serial numbers on the ransom money be properly recorded. Wilson later became chief of the Secret Service.

Tuesday, October 18, 2011

13 THINGS YOUR PODIATRIST WON'T TELL YOU

In their November magazine, Michelle Crouch wrote about 13 Things Your Podiatrist Won't Tell You -- "what does that have to do with me?" is what you are asking, 2 of the 13 involve salons.

#3: Infections from nail salons keep us in business. If you want a pedicure, book the first appointment of the day, when the equipment is cleaner. Those footbaths can be especially germy. Even if the technicians spray the basin between customers, many of the tubs have drains and filters that don't get cleaned.

#10: I don't have a problem with people getting pedicures, but please don't shave right before you go. You might be embarrassed by your stubble, but it will be worse when bacteria and fungus enter the microscopic nicks on your ankle and give you an infection.

Remember that your clients read these articles too.

Monday, October 17, 2011

Raffle Winner

A. You win... and of course the IRS wins. This is taxable and you most likely be receiving a 1099 for this. If the trip is valued at $12,000 at a 40% tax rate, you will be paying about $4,800 in income taxes on your 2011 tax return for this.

Enjoy the trip.

Friday, October 14, 2011

PROTESTS ON WALL STREET

As I watch the protests on Wall Street and the ones spreading across the country, I thought of this book and the following statements. If anybody that reads this understands what the protesters are trying to get across would you please email me so that maybe I can understand.

Here are the concepts that I pulled out of my quotes bag.

1. You cannot legislate the poor into prosperity by legislating the wealthy out of prosperity.

2. What one person receives without working for, another person must work for without receiving.

3. The government cannot give to anybody anything that the government does not first take from somebody else.

4. You cannot multiply wealth by dividing it.

5. When half of the people get the idea that they do not have to work because the other half is going to take care of them, and when the other half gets the idea that it does no good to work because somebody else is going to get what they work for, that is the beginning of the end of any nation.

Thursday, October 13, 2011

TEN TAX TIPS FOR INDIVIDUALS SELLING THEIR HOME

1. In general, you are eligible to exclude the gain from income if you have owned and used your home as your main home for two years out of the five years prior to the date of its sale.

2. If you have a gain from the sale of your main home, you may be able to exclude up to $250,000 of the gain from your income ($500,000 on a joint return in most cases).

3. You are not eligible for the exclusion if you excluded the gain from the sale of another home during the two-year period prior to the sale of your home.

4. If you can exclude all of the gain, you do not need to report the sale on your tax return.

5. If you have a gain that cannot be excluded, it is taxable. You must report it on Form 1040, Schedule D, Capital Gains and Losses.

6. You cannot deduct a loss from the sale of your main home.

7. Worksheets are included in Publication 523, Selling Your Home, to help you figure the adjusted basis of the home you sold, the gain (or loss) on the sale, and the gain that you can exclude.

8. If you have more than one home, you can exclude a gain only from the sale of your main home. You must pay tax on the gain from selling any other home. If you have two homes and live in both of them, your main home is ordinarily the one you live in most of the time.

9. If you received the first-time homebuyer credit and within 36 months of the date of purchase, the property is no longer used as your principal residence, you are required to repay the credit. Repayment of the full credit is due with the income tax return for the year the home ceased to be your principal residence, using Form 5405, First-Time Homebuyer Credit and Repayment of the Credit. The full amount of the credit is reflected as additional tax on that year’s tax return.

10. When you move, be sure to update your address with the IRS and the U.S. Postal Service to ensure you receive refunds or correspondence from the IRS. Use Form 8822, Change of Address, to notify the IRS of your address change.

ACCOUNTANTS IN THE MOVIES

In Hollywood, accounting can seem like a pretty glamorous profession, or not.

In Hollywood, accounting can seem like a pretty glamorous profession, or not.Will Ferrell plays lonely IRS agent Harold Crick in the 2006 comedy-drama "Stranger Than Fiction." Harold has been assigned to audit Maggie Gyllenhaal, and falls in love with her. However, he keeps hearing a strange British-sounding voice in his head, and he discovers it's author Emma Thompson, whom he tracks down through her tax records. Turns out she has been writing about his life and trying to decide how he will die in her next book.

Wednesday, October 12, 2011

THE SALON INDUSTRY LOSES A FRIEND

I found out a few hours ago that my good friend Ken Cassidy passed away. Ken had been struggling with some lung issues for the few years. I saw him last in June 18 at the Energizing Summit. He told me he had to use a respirator from time to time but he never let on that it was serious. I will get into his importance to the industry in a bit but before I do that I have to tell you a little bit more about the man.

I will never forget the first time I met Ken. In November 2001, right after the 9/11 tragedy I was speaking at the first Suzie Fields, Your Beauty Network Symposium in San Diego. My program ended right before lunch. They served a box lunch for everyone. By the time I got off the stage and finished answering questions the lunch was over. As I walked over to a booth that they had set up for me over wakes a guy I didn't know and said, "I figured you were going to miss lunch so I saved half my lunch for you."

That was the type of guy Ken was. Over the years he was always trying to advance the industry. He was the guru on booth rental and if clients were trying to get their business cleaned up I would send them to Ken. He had all the contracts and agreements to help.

Several times Ken and I would be speaking at the same conference so I got to know him quite well. He was always introduced me to people in the industry. He had quite a network.

After the Energizing Summit in Los Angeles, we had dinner together. We talked about his son and his investment property but mostly we talked about the salon business. He had such passion about the industry and so much passion about life and helping others. I will miss him, but I can tell you this, I will never forget that guy with the long hair making sure that I had lunch and the impression it had on me. He made a difference because over the last 10 years I have looked for opportunities to help just like Ken.

Tuesday, October 11, 2011

TAX SAVINGS IN MILLIONAIRE TAX BILL

Saturday, October 8, 2011

IF YOU HAVE BEEN USING INDEPENDENT CONTRACTORS TAKE NOTE

The Internal Revenue Service announced a new program that will enable some employers to resolve worker classification issues by voluntarily reclassifying their workers. This new program will allow employers to resolve worker classification disputes by making a minimal payment covering past payroll tax obligations rather than waiting for an IRS audit. Full details, including FAQs, are available on the Employment Tax pages of IRS.gov, and in Announcement 2011-64.

Under the program, eligible employers can obtain relief from federal payroll taxes they may have owed for the past, if they prospectively treat workers as employees. The VCSP is available to businesses, tax-exempt organizations and government entities that are uncertain whether to treat their workers or a class or group of workers as employees or independent contractors, and now want to correctly treat these workers as employees.

To be eligible, an applicant must:

• Consistently have treated the workers in the past as nonemployees;

• Have filed all required Forms 1099 for the workers for the previous three years; and

• Not be under audit by the IRS, the Department of Labor or a state agency concerning the classification of these workers.

Interested employers can apply for the program by filing Form 8952, Application for Voluntary Classification Settlement Program, at least 60 days before they want to begin treating the workers as employees.

Employers accepted into the program will pay an amount effectively equaling just over 1 percent of the wages paid to the reclassified workers for the past year. No interest or penalties will be due, and the employers will not be audited on payroll taxes related to these workers for prior years. Participating employers will, for the first three years under the program, be subject to a special six-year statute of limitations, rather than the usual three years that generally applies to payroll taxes.

Friday, October 7, 2011

FACT-CHECKING WARREN BUFFETT

Warren Buffett's much-discussed op-ed arguing that high-income earners aren't paying enough taxes makes the following claim:

"Last year my federal tax bill — the income tax I paid, as well as payroll taxes paid by me and on my behalf — was $6,938,744. That sounds like a lot of money. But what I paid was only 17.4 percent of my taxable income — and that’s actually a lower percentage than was paid by any of the other 20 people in our office. Their tax burdens ranged from 33 percent to 41 percent and averaged 36 percent."

To me, the effective rates he claims for other workers in his office seem too high to be realistic, and I can't figure out how he calculated them, even if you include all payroll (employee and employer) taxes. Even if you assume the scenario that leads to the highest possible tax burden (single filer, no deductions), a taxpayer would have to make at least $285,388 (in 2010) before his or her effective rate reaches 33 percent. 41 percent is impossible, as far as I can tell: the limit of total taxes over total income, as income approaches infinity, is 37.358%. That's the highest possible effective rate anyone could have paid in 2010, if you include income and all payroll taxes.

To demonstrate this, I've made a little calculator which shows the maximum possible effective rate for any income amount. Try it out on the Tax Foundation website.